ESG in ERISA Plans: From “Nice to Have” to Fiduciary Obligation

ESG in ERISA Plans: From “Nice to Have” to Fiduciary Obligation

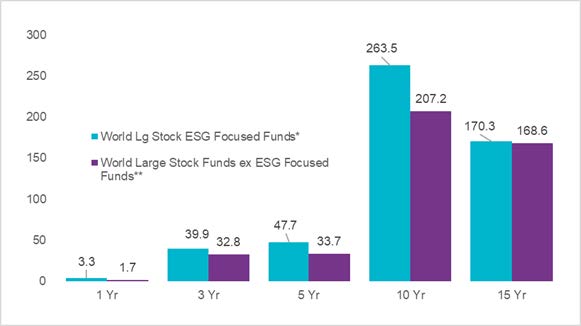

ESG-factor based investing – using environmental, social, and governance considerations in the investment selection process – may not be a household name quite yet. But it’s been around long enough to have an impressive 15-year track record. According to 3/31/19 data from Morningstar, World Large Stock ESG Focused Funds outperformed the non-ESG funds over the 1, 3, 5, 10 and 15-year periods.1

During the same time, ESG investing has been gaining traction among DC plan participants – particularly Millennial investors. Recent data from the Natixis Investment Managers DC Plan Participant Survey shows that:2

- 75% of plan participants say it’s important to make the world a better place while growing their personal assets.

- 61% say these kinds of investments would make them more likely to contribute to their plan.

- But only 13% of participants say their plan currently offers ESG options.

How sustainable is your plan?

Plan sponsors who aren’t keeping up with participant demand ignore these trends at their peril. It’s not just a matter of alienating current plan participants. Sponsors may also be coming up short on their fiduciary responsibilities. Increasingly, offering ESG options in ERISA plans is becoming an obligation, not an option – because sustainable investing makes sound business sense on several levels.

- Sustainability has moved beyond the confines of niche businesses and purely environmental issues. It now encompasses the social records of companies, more diverse representation on boards, equal pay, #metoo – all issues that can pose reputational risk for companies and investment risk for their shareholders.

- These trends have been compounded by the transition from defined benefit (DB) to defined contribution (DC) plans that has shifted investment risk to plan participants. For responsible plan sponsors, pressure is on to provide more ways for participants to lower their risk profile.

- Many of the fastest-growing companies already incorporate ESG values into their corporate mission – but their retirement plan investments may not be keeping up.

- In today’s high employment economy, companies have to try harder to attract the best talent; there is a growing emphasis on reflecting corporate/sustainable values in retirement plan investment offerings.

- As world economics have changed, retirement planning needs to evolve along with it, taking clues from the Millennial generation which represents a growing percentage of the workforce.

Many of these observations are discussed in research recently published by UN PRI – the United Nations Principles for Responsible Investment – Untangling Stakeholders for Broader Impact: ERISA Plans and ESG Incorporation.3 The authors point out that the Millennial generation – the most ethnically diverse demographic in the US – will make up 75% of the global workforce by 2025. Their values and preferences are driving change globally as well as in the US.

Evolution, not revolution

The report specifically describes the evolution in the attitudes of ERISA plan sponsors toward the incorporation of ESG factors into their plans over the past 30 years. Recognition and acceptance have been a process, starting with “articulating that ESG is not prohibited,” then “demonstrating that ESG incorporation creates clear benefits for investors,” to where we are now: “viewing ESG incorporation as a core element of fiduciary duty.”

- AND YET – while the US accounts for the largest share of pension assets globally, US plan sponsors are lagging their international peers in incorporating ESG factors into their investment decisions. Compliance thus far has been voluntary not mandatory.

- The basics are in place for building sustainable retirement savings for plan participants.

Take the next steps

This may be the year to address the topic directly with your plan advisor or board of directors in your next plan review. Fiduciary best practices to consider include:

- Aligning plan investment guidelines with ESG and CSR (corporate social responsibility) programs already in place at your company

- Including ESG selection criteria and questions in requests for proposals (RFPs)

- Updating your Investment Policy Statement to require ESG analysis when selecting and monitoring investments

- Requiring investment consultants to ask investment managers how they incorporate ESG

- Selecting a recordkeeper with ESG products on its platform

- Choosing ESG funds as a QDIA (qualified default investment alternative)

There are many reasons to align your retirement plan with your corporate values – and very few reasons not to. Put the topic on the agenda with your plan advisor in this year’s plan review. Investing sustainably for retirement security is no longer a luxury – it’s a necessity.

Average cumulative total returns (%) for mutual funds and ETFs in World Large Stock category (3/31/19)

1 Source: Morningstar

2 Natixis Investment Managers, Survey of US Defined Contribution Plan Participants conducted by CoreData Research, January and February 2019. Survey included 1000 US workers, 700 being plan participants and 300 being non- participants. Of the 1000 respondents, 503 were Millennials (age 23-38), 249 were Gen X (age 39-54) and 248 were Baby Boomers (age 55-73).

3 Source: Goedeke Consulting and PRI, Untangling Stakeholders for Broader Impact: ERISA Plans and ESG Incorporation, 2018

You Can Invest With Your Values

Retirement plans for long-term growth with the benefit of creating a safe, just, and sustainable world.

Social(k) offers hundreds of investments using Environmental, Social, and Governance, (i.e. ESG screened investments) backed by a plethora of Financial research. Structured into traditional Mutual Funds, Social(k) helps you sleep at night knowing that you’re pursuing the brightest possible future for your retirement and our planet.