10 Reasons Why ESG Is Sustainable And Won’t Be Stopped

Although demonized, ESG and sustainable investing will survive the backlash.

It’s been a time of reckoning for environmental, social, and governance analysis and sustainable investing. A hurricane of criticism has arisen in recent years, with accusations ranging from deceptiveness and ineffectiveness to a secret agenda to impose “woke” values on capitalism and society.(1)

Article originally appeared here

Lately, such accusations are at the heart of a Republican Party attack against so-called “woke capitalism,” or companies espousing social and environmental causes. The loudest critics are a lineup of aspiring presidential candidates, including former Vice President Mike Pence and Florida Gov. Ron DeSantis, who has proposed legislation to stop his state’s public pension fund from considering ESG factors when investing its assets.

Criticisms have also centered around greenwashing, in which fund managers (and companies) are accused of misleading customers by exaggerating the sustainability attributes of their products. And a broader condemnation is that ESG is inadequate to address the planet’s environmental challenges, that it focuses on profits for shareholders rather than on creating solutions. Finally, it’s been blasted for having a “measurement problem” that allows people to game raters’ scoring systems.

The latter criticisms are legitimate, and as ESG analysis and sustainable investing evolve, the field must address each one. The position of many Republicans on ESG presents a new type of challenge that has moved from stump speeches during an election year to anti-ESG exchange-traded funds and will require continued engagement from everyone.

Yet despite the accusations—some deserved—ESG and sustainable investing are not going anywhere. Indeed, the criticisms have had the beneficial effect of improving the efficacy of sustainable-investment approaches, increasing investor education, and bolstering the understanding that there is no one-size-fits-all investment strategy and that often practitioners need to make hard investing choices.

Here, I offer 10 important reasons why ESG and sustainable investing are here to stay.

1. ESG Offers a Fuller View of Risk

Risk is a key element of investing, and for fiduciaries, assessing it has become critical. Augmenting traditional investment analysis with ESG information provides a more complete information set. It gets at issues that are of clear material concern to companies and investors today, including climate, pollution, treatment of workers, respect for customers, supply chain oversight, and brand and reputation.

Make no mistake: These risks matter. Consider how two apparel companies with similar supply chains address the risk of a cotton crop dying from climate-induced drought. Would you invest in the company that ignores it or the one that recognizes the risk and finds a backup supply chain? Those who manage money for investors—from the biggest pools to the smallest individual accounts—believe it’s their duty to account for such risk. Since 2005, when the law firm Freshfields Bruckhaus Deringer created a legal framework for incorporating ESG considerations into institutional investment, investors have regarded ESG as consistent with their fiduciary duty.

“Virtually all asset managers use ESG information,” says Jon Hale, a director on Morningstar’s sustainability research team.

Indeed, a Russell Investments survey of asset managers last year found that 82% of U.S.-based asset managers systematically incorporate ESG information in their investment process. The percentage approaches 100% in the United Kingdom and Europe.

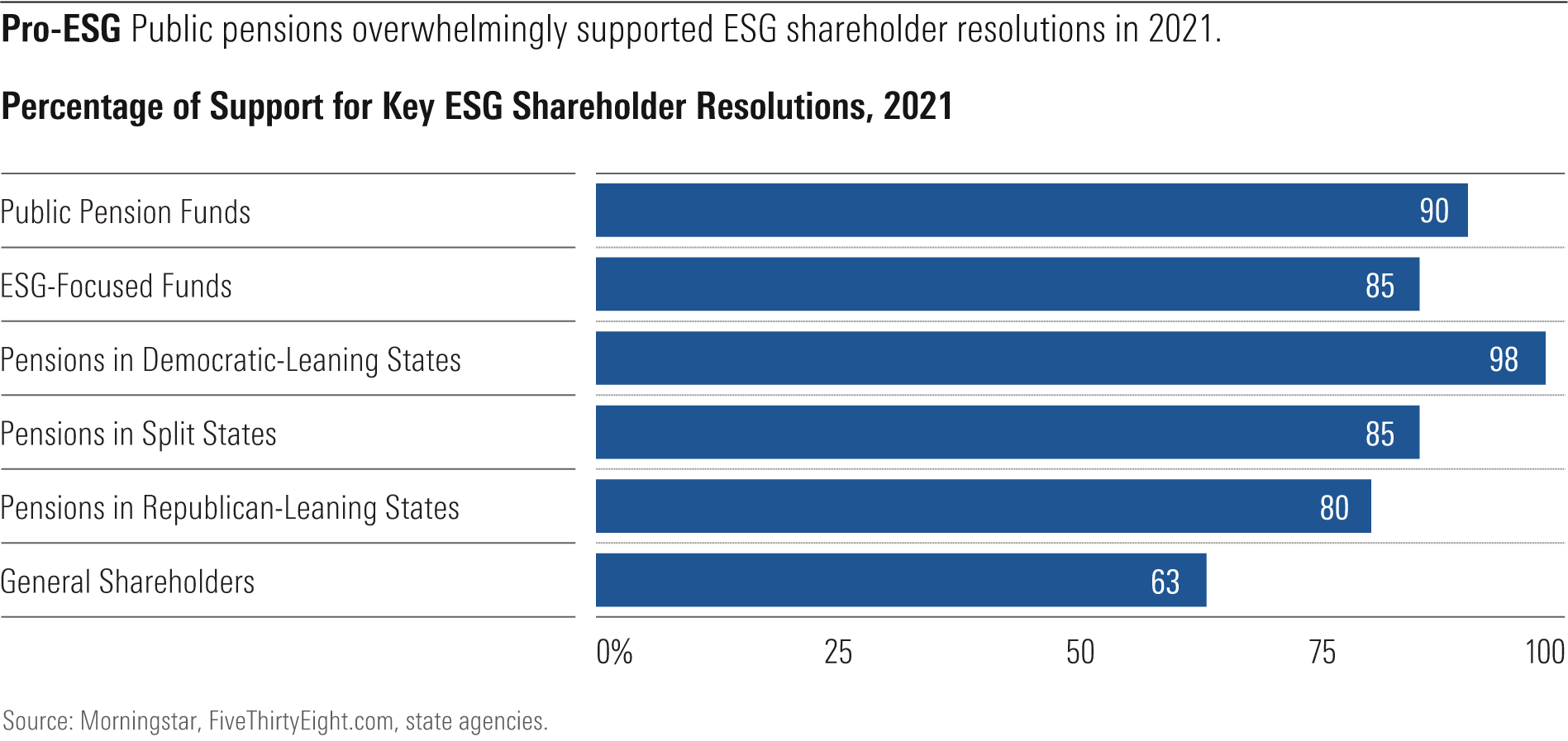

“For investment managers like me, who oversees New York City’s pension funds, understanding those exposures is essential to mitigating risk across our portfolio to secure strong returns for the city’s public-sector workers,” wrote New York City comptroller Brad Lander in an essay for The New York Times. Indeed, U.S. pension funds are already voting heavily in favor of ESG resolutions, according to Morningstar research on the 2021 proxy season.

A Morningstar study of 500 global asset owners, including pensions, sovereign wealth funds, and insurers, found that ESG factors are “very material” or “fairly material” in investing.

Why else does using ESG information make sense from a risk perspective? Because of the failures of conventional accounting metrics in recent years.

Wrote corporate governance expert Nell Minow: “If we have learned anything from the market upheavals of the last 40 years, from the dot.com implosion to the Enron-era accounting failures to the financial meltdown caused by wildly inaccurate ratings of bundled sub-prime derivatives, it is that GAAP is inadequate to give us the information we need to assess risk and return, particularly over the long term. ESG is still in its earliest stages, but already it is a vital element that enhances our understanding of value as we make our investment decisions.”

2. Identifying the Risks Leads to Opportunities

For smart companies, the same risks also present opportunities. That’s part of the reason why ESG is becoming entrenched in mainstream investing. In 2021, the International Energy Agency released its road map for the global energy sector, reflecting emissions reduction goals, aimed at forestalling the worst effects of global warming. The IEA forecast that renewable energy will account for nearly 90% of global electricity generation by 2050. The march to net-zero emissions will create “the greatest commercial opportunity of our age,” declared Mark Carney, the former chief of the Bank of England.

ESG is now part of the framework for identifying opportunities as the new economy blossoms. Controversially, some ESG investors consider the riskiest companies an opportunity if these companies are in the process of transforming themselves.

“The allocation of capital amongst publicly traded companies is one piece of that overall climate transition that the vast majority of scientists will tell you needs to happen,” says Eric Veiel, head of global equity for investment manager T. Rowe Price. “More and more investors want to invest in those companies because they feel they will be around and will have long-term business viability.”

3. Rise of Stakeholder Capitalism Is Good for Companies

Companies are reshaping themselves to appeal to talented workers who are more diverse than ever and to customers who are increasingly consuming in line with their values. This refashioning is called stakeholder capitalism, in which management considers the needs of an array of stakeholders equal in importance to shareholders. Companies do so on the theory that it will create more loyal relationships over the long term that will ultimately enhance company value. (Corporate social responsibility, a related concept, is about the company’s own framework of sustainability plans, which ESG measures.)

Stakeholder capitalism can be good for shareholders, too. According to one study of large-cap companies in the United States, racial and ethnic diversity on corporate boards had a significant positive impact on their stock prices.

Martin Lipton, the celebrated corporate lawyer, recently wrote: “Stakeholder capitalism and ESG are fundamentally frameworks to enhance the sustainable long-term value of a corporation. Both are tools for boards and management to guide business strategy, risk management and capital allocation in a manner that best serves the financial well-being of a business, and in turn, the interests of shareholders.”

Publicly traded companies also are incorporating ESG metrics to track their progress. In a preliminary study of S&P 500 companies, consultant Mercer found that use of an ESG metric increased to 46% from 35% in executive incentive plans. A further 9% of companies disclosed that they intend to use an ESG metric in 2023.

These metrics are something that Lisa Pollina, who serves on the board of directors for insurer Munich Re and water technology firm Energy Recovery ERII, already looks at. “From a board perspective, I’m looking at governance, compliance, ethics, business continuity,” she says. “I’m looking at developing diverse talent, understanding and looking at climate change. Does any of that go away if you don’t call it ESG? No.”

Julie Sweet, the CEO of Accenture, recently said that sustainability “matters to our employees from a recruiting standpoint, it matters to our clients, it’s part of our regulatory landscape, it matters to consumers. That’s not changing because of what politicians want to call it.”

4. Regulations Are Leading to Improvements

Regulations are increasingly addressing ESG issues—meaning that disclosures and fund managers’ literature will get better, too. Central banks have already awakened to the risks that climate change poses to the global economy and are considering how to add ESG bonds to their reserves. Regulators are especially active because, in the U.S. at least, legislatures are divided.

“The policy solution is focusing on things like disclosure because you can’t get legislation through and the net-zero targets are so far away. [This is] what they can get done right now,” says Joyce Chang, global head of research for JPMorgan.

Rule-setting and enforcement have speeded up. In Europe, regulators have adopted two groundbreaking classification and disclosure regulatory frameworks as part of the European Union’s action plan on sustainable finance. For example, the EU is requiring fund managers to classify products so investors can see how green they are. What we think of as general ESG funds are in one classification; more thematic or impact-focused funds are in another.

In the U.S., the SEC has also gotten in the game, proposing rules for companies on climate reporting. Other rules would require fund managers to disclose additional information on ESG in official fund documents and require funds with certain names to invest 80% of their assets in investments suggested by that name.

Already, information available to investors is getting better. This year, Morningstar removed the ESG tag from more than 1,000 funds because analysts tightened their criteria.

Regulators have bolstered enforcement. This year, German police raided the Frankfurt offices of Deutsche Bank DBK:GR and its asset manager DWS after whistleblower claims by the firm’s former sustainability officer that it overstated its ESG capabilities to investors. The investment advisory division of Bank of New York Mellon BK agreed to pay $1.5 million to the SEC to settle charges of making misstatements about its sustainable practices in six mutual funds. The SEC is also looking at whether Goldman Sachs GS mutual funds overstated their ESG capabilities.

There’s a fear that regulations will require an excessively large paper trail. Yet these regulations will force asset managers and companies to be clearer about how they’re achieving what they claim. They also provide directors with tools to measure the issues they want to track. And they give investors a level of comfort about these metrics.

“Things have to be verified in a standardized format. Right now, it’s creating distrust between companies and owners,” says Andrew Behar, CEO of As You Sow, the shareholder advocacy nonprofit.

Meanwhile, fund names should accurately reflect their ESG practices. “There is no connection between a prospectus and its holdings,” Behar says. In January, As You Sow published a study of 94 mutual funds and ETFs with the word ESG in their name. Based on the firm’s criteria of what makes a good ESG fund, 60 received a D or an F grade.

One possible outcome of the rulemaking is that it will give large asset managers an even greater opportunity to dominate fund flows. “They have the resources, and if you’re a new manager, are you going to be overwhelmed by the amount of disclosure?” says Vadim Avdeychik, a partner at law firm Clifford Chance.

5. Sustainable Investing Is Growing ...

Funds that focus on the integration of ESG information, ESG exclusions, sustainability themes, or impact assessments have gathered a tremendous amount of assets. By 2020, global sustainable funds totaled $35.3 trillion, or more than a third of professionally managed assets. In the U.S., they accounted for $17.1 trillion, according to the US SIF Foundation.

The potential looks even larger as more investors adopt ESG. By the end of 2021, the number of signatories to the United Nations-backed Principles for Responsible Investment, which works to incorporate ESG factors into investment decisions, had grown to 3,826 representing $121.3 trillion in assets, up from 890 signatories and $24 trillion just 10 years before. The signers represent a majority of the world’s professionally managed investments.

6. ... Particularly Among Women and Young Investors

More individual investors want to align their investments with their sustainability preferences. According to a Gallup Poll, nearly half of investors are very or somewhat interested in buying sustainable-investment funds.

For young people, who will suffer the consequences of climate change in the coming decades, the numbers are much higher. In a survey of U.S. individual investors who are 18 years and older with minimum investable assets of $100,000, 79% were interested in sustainable investing. For millennials, who will benefit from an estimated $30 trillion wealth transfer, the number clocked in at 99%, up from 95% two years before.

“Most people try to make decisions in their lives that are consistent with their beliefs,” Morningstar’s Hale says. “Their decisions express who they are as a person.”

Sustainable funds, with their mixed bag of approaches, are appealing in this context. Tobacco, weapons, and fossil fuel are common exclusions. Others might pursue a particular theme or might focus on ESG risks and other opportunities.

The rise of direct and custom indexing is expected to appeal to these investors. With direct indexing, investors own a benchmark’s underlying shares but can exclude any company they want. In the past year, Fidelity, Schwab, and Vanguard have all introduced direct-indexing products. Morningstar is set to launch a direct-indexing product later this year.

“I haven’t had any clients wanting to get out of ESG,” despite this year’s backlash, says Haleh Moddasser, a Chapel Hill, North Carolina-based financial advisor for Stearns Financial, which runs $2 billion in assets. She oversees gender-lens and ESG portfolios, as well as conventional portfolios. She says that one client chose Moddasser’s practice because of the focus on ESG. “This is a huge shift in what consumers and investors want.”

7. Performance Is on Par

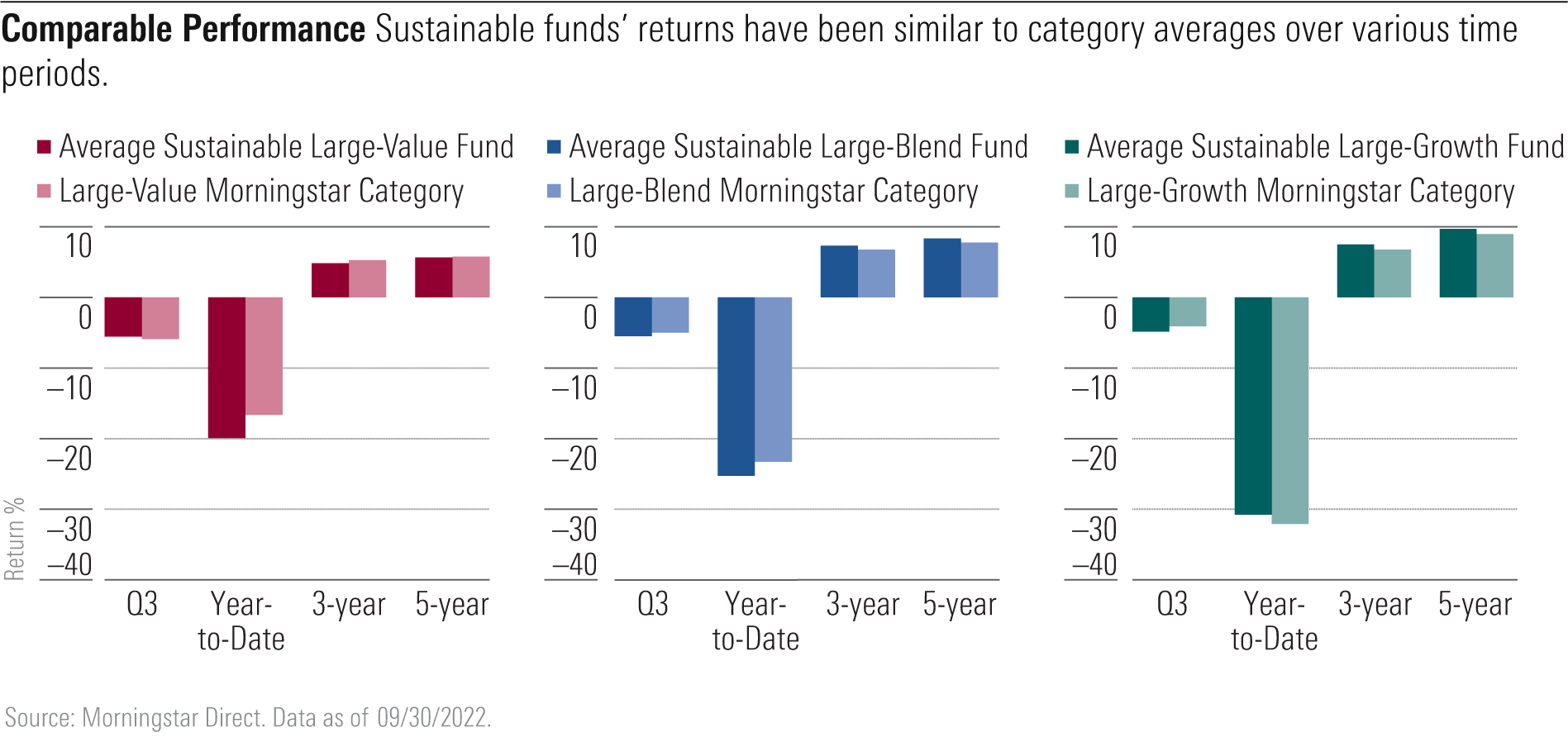

Sustainable funds are showing that they can perform on par with traditional funds, Hale says. Until this year, sustainable funds generally outperformed their traditional counterparts. So far in 2022, they have lagged broad indexes, partly because of the strong performance of fossil-fuel-based energy. Meanwhile, inflation hit growth stocks, particularly the tech and internet giants. As many of these companies perform well on measures of how they handle material ESG issues, they tend to be overweight in many sustainable equity fund portfolios.

However, when compared against other funds with similar overweights, these funds are holding up well in this year’s bear market. Large-growth funds in Morningstar’s U.S. Sustainable Funds Landscape lost 30.8% for the year to date through September, compared with 32.1% for the large-growth Morningstar Category average.

8. More Shareholders Are Voting

Sustainable funds are showing, through engagement and proxy voting, that they can help create positive ESG outcomes. “This is the great untold, and still unfolding, story of sustainable investing,” Hale says.

Consider Costco COST: In an overwhelming defeat for Costco’s management, 70% of shareholders voted in January for the mega-retailer to adopt a more wide-ranging plan to slash the greenhouse gas emissions that cause global warming by trapping heat in the atmosphere. The retailer previously advised the shareholders to turn down the proposal at its annual proxy vote.

“With this vote, investors are demonstrating that they expect Costco to align with its peers by accelerating work to reduce the climate impact of its supply chains and raising the level of ambition of its emissions reduction goals,” Leslie Samuelrich, president of Green Century, the investment firm that made the successful proposal, said in a press release.

Many investors don’t realize how much active ownership activities are being undertaken by many sustainable funds. In the year to June 2022, company boards opposed more than 250 environmental and social shareholder resolutions, versus 145 in the same period last year, according to Lindsey Stewart, director of investment stewardship research at Morningstar.

Expect more investors to participate. Already, BlackRock BLK is allowing more institutional clients and individuals to vote their index fund shares. That removes a giant rubber stamp on corporate management’s decisions. Direct indexing will also give individuals the opportunity to vote their underlying shares. But more than that, it’s becoming easier to vote one’s values. For example, Behar says that As You Sow and Proxy Impact, a proxy-voting firm based on ESG principles, have made their voting slate available on the Broadridge institutional voting platform.

Meanwhile, social media is also changing the dynamic for younger investors. This year, electric truck maker Nikola NKLA drummed up support to increase its number of authorized shares—a move opposed by the company’s founder and largest shareholder, who faced federal fraud charges—by targeting retail shareholders on Reddit and other outlets.

These actions, as well as increased flows into funds using ESG information, are having an impact on corporate behavior. “I’d say any dollar put into ESG investments is contributing to this idea that companies are pursuing” greater sustainability, Hale says.

9. Countering the Broad Consensus on ESG Would Be Difficult

Reversing ESG’s momentum would take a herculean effort at this point. “There would have to be a view that in fact ESG issues are not material,” says Tom Kuh, Morningstar’s global head of ESG strategy for indexes. “A lot of effort has already been put into answering that question. There seems to be pretty broad consensus that, yes, ESG issues are indeed material.”

10. ESG May Be Better for Investor Outcomes

Ultimately, the case for ESG “revolves around investors’ rights to have their investments reflect their beliefs and in the potential for that connection to increase their commitment to their investments, thus both increasing the potential number of investors and upping their collective willingness to stick with their investments through tough times,” wrote Don Phillips in the Q1 2022 issue of Morningstar magazine. “When a portfolio becomes a cause, investors are apt to be more dedicated to it. Wise fund companies have long recognized this possibility.”

Phillips said that investment managers like Vanguard, DFA, and American Funds have created dedicated communities deeply steeped in their investment philosophies. “ESG has the potential to do the same,” he said.

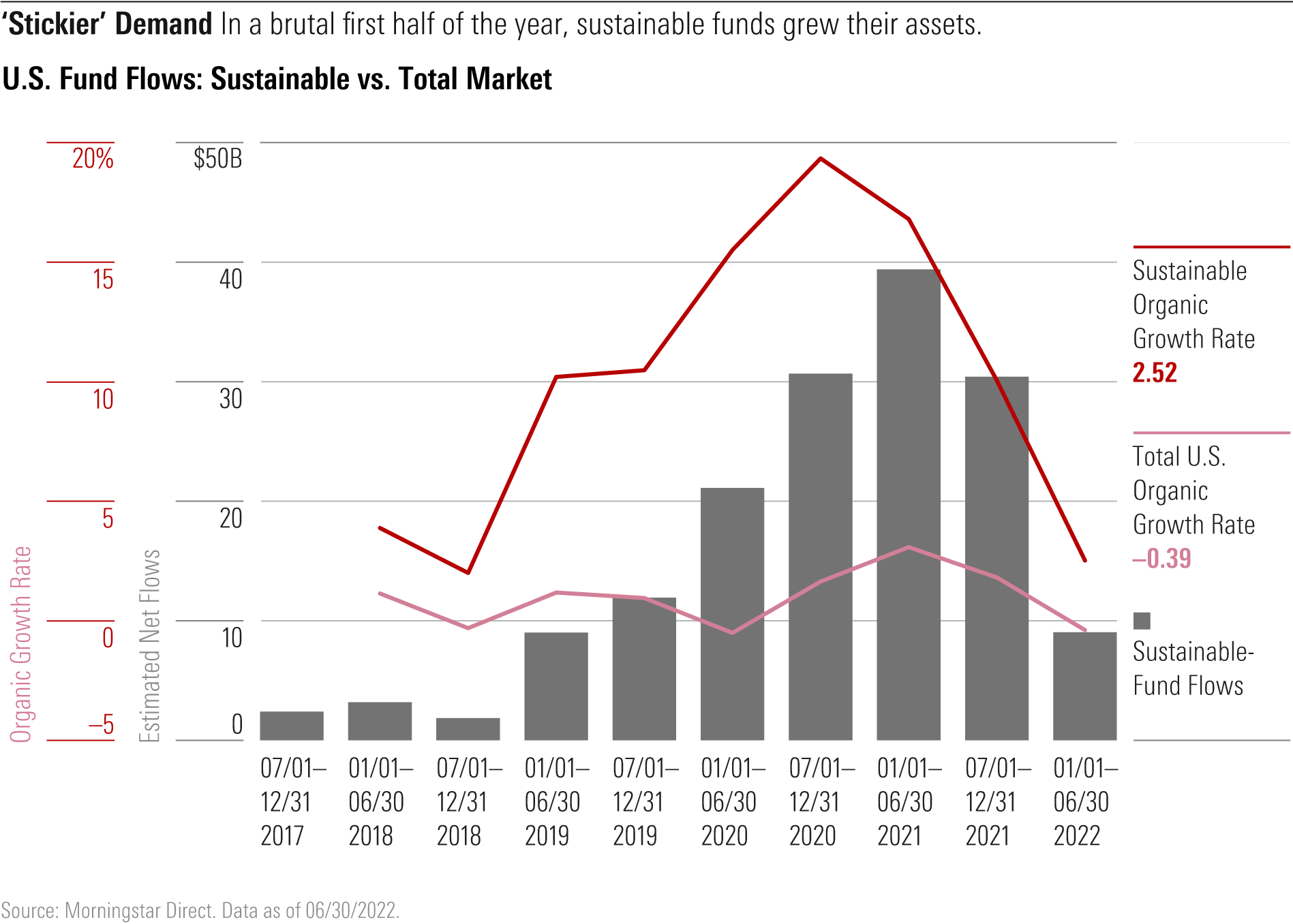

Phillips may have a point. A look at large-cap sustainable-investing funds shows that in 2020, the average redemption rate was 20.3%. That suggests an average holding period of 4.9 years. For the average equity fund tracked by the Investment Company Institute, it was about 4.2 years.

“Flows data shows that investor demand for sustainable funds is ‘stickier’ than demand for non-ESG funds,” says Alyssa Stankiewicz, associate director of sustainability research at Morningstar. In the first half of 2022, U.S. sustainable-fund assets grew by 2.5%; the broader universe of U.S. mutual funds shrank by 0.39% over the same period.

“This supports the idea that sustainability-focused investors are in it for the long haul and less likely to be spooked by short periods of underperformance,” Stankiewicz says. “For most of these investors, it’s a combination of values alignment and conviction in these funds’ ability to drive strong returns in the long term.”

Full Steam Ahead

For all these reasons, ESG and sustainable investing will continue to grow, despite the barrage of criticism and accusations. FUSE Research Network, which analyzes the fund industry, surveyed more than 5,000 advisors at the end of 2021. It found that the advisors in its survey group expected to grow their average allocation to ESG to 16% by 2023 from 9% in 2021. The primary reasons? Requests from clients, an advisor’s values-based views, and the notion that it’s a way to reach new clients.

“A client will never ask me about alpha or beta, but they will bring a New York Times opinion piece and say, ‘This concerns me,’” says Cameron Barsness, a partner at Seattle-based Kutscher Benner Barsness & Stevens, which oversees about $450 million for clients. In response, “we get to show the depth and due diligence we do on a fund.”

David Cantor is a principal at Santa Fe, New Mexico-based LongView Asset Management. So far this year, Cantor says that he is continuing to see inflows into his sustainable portfolios. “The controversy is an opportunity for us to talk to our clients and prospective clients about what this is all about—to use our power as shareholders to push companies towards a renewable economy and a modicum of social justice,” he says.

Says Loren Fox, FUSE’s director of research: “We continue to believe that ESG will experience broader adoption and continued growth, even if ESG has garnered somewhat outsized attention relative to its proportion of the industry. It’s also clear that ESG investing has a lot of evolution ahead of it.”

Article originally appeared here

To learn more about the importance of ESG read these articles:

You Can Invest With Your Values

Retirement plans for long-term growth with the benefit of creating a safe, just, and sustainable world.

Social(k) offers hundreds of investments using Environmental, Social, and Governance, (i.e. ESG screened investments) backed by a plethora of Financial research. Structured into traditional Mutual Funds, Social(k) helps you sleep at night knowing that you’re pursuing the brightest possible future for your retirement and our planet.